FAssets Agent Vault Explained

FAssets use two collateral types: Agent’s Vault (stablecoins like USDX) & Pool Collateral (tokens like SGB/FLR). This post dives into Agent’s Vault—how it works & why it matters.

How Agent Vaults Work

Vault Collateral is self-managed independently by agents. This is where agents provide stablecoins (currently USDX on Songbird) at a ratio of at least 1.3x the underlying tokens minted (i.e., XRP).

An agent's collateral ratio (CR) for their vault is dynamic, changing as FAssets are minted and redeemed. To be considered both healthy and safe, an agent's CR should always be above 1.3.

Collateral Ratio Thresholds

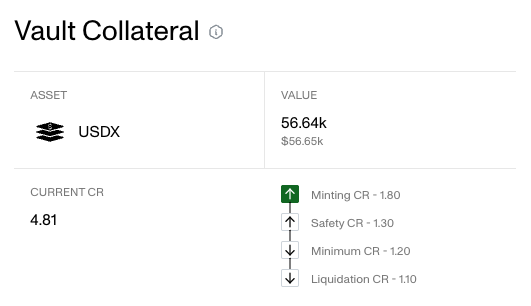

Agents have four CR thresholds:

- Minting CR: The minimum collateral ratio required for users to mint FXRP. This value is set by the agent and in part determines the volume of assets that can be minted.

- Safety CR: The level an agent must reach to stop liquidations (i.e., they must increase to this value to escape liquidation mode, which happens at the liquidation CR).

- Minimum CR: A critical level that must be maintained to avoid liquidation but risks liquidations if it falls below this level for too long.

- Liquidation CR: The final level which, if breached (moves below), liquidations of the agent's USDX can begin immediately.

Visual representation of the different Collateral Ratio thresholds in an Agent's Vault

Visual representation of the different Collateral Ratio thresholds in an Agent's Vault

Understanding Minting Capacity

Agents have control over their minting CR which creates a buffer between their minting CR and the minimum CR. Users are unable to mint with the agent when their collataral ratio is below the minting CR thus reducing risk of falling below further collateral thresholds during underlying token price volatility (this essentially provides a reserve amount of collateral to handle an increase of underlying token price).

When an agent's available minting capacity is 100% (i.e., the agent has all its collateral available to use), their CR is high as the ratio of USDX to minted FXRP is high. As FXRP is minted through the agent, their CR will decrease until it reaches their set minting CR, in which case users can no longer mint with the agent.

An agent is at its greatest risk of liquidation events when it has minted to 100% of its capacity, as this is when its CR is the lowest. Risk is introduced if the underlying tokens price increases which forces a higher collateral requirement. Conversely, if the underlying tokens price reduces, the agents CR improves allowing for more minting. As long as the underlying tokens price remains stable the agent's position is considered safe and healthy so long as it's above the safety CR (1.3).

Increasing Minting Capacity

For the agent to increase its minting capacity (in other words, increase their CR) after being completely minted out, they can:

- Add more stablecoins (USDX) to their vault

- Send the underlying tokens, that they have received in minting FXRP, to the Core Vault

The Core Vault: A Game-Changing Feature

The recently introduced Core Vault in FAssets v1.1 is exceptional in assisting agents with increasing their CR, which in turn allows for minting more FAssets. To truly grasp this, you must understand the relationship between the FAssets' underlying token (i.e., XRP) and the agent's collateral.

How It Works

When a user mints FXRP, they are directly sending XRP to an agent's XRP wallet, which they have complete control over. To provide security over the assets and disincentivize the agent stealing the XRP, the agent puts up their own money: stablecoins locked in a smart contract and effectively bound with the user's FXRP.

If the agent were to move the underlying XRP tokens out of their specified agent address, their stablecoin position would be liquidated, and users would be able to redeem their FXRP back with a premium (remembering that it's over-collateralized, for this very reason). This effectively penalizes the agent for disrupting the system.

The Trustless System Concept

Now, if it were impossible for the agent to move the underlying token except for redemptions (converting FXRP back to XRP), collateral wouldn't be required, as this would be considered a trustless system. But since we're dealing with an external chain, and one that doesn't have smart contracts, we cannot achieve that.

We can, however, mimic this idea with a multi-sig wallet on the underlying chain: the Core Vault. Agents can send underlying tokens (XRP) to this multi-sig wallet that they do not control. As we just explored, if the agent cannot steal the XRP, then the collateral for the FXRP isn't required.

Core Vault Benefits

In simple terms, when XRP is sent to the Core Vault:

- The same amount of FXRP is effectively backed 1:1 with its underlying amount

- Over-collateralization isn't required, as users only expect to redeem their FXRP for XRP

- Once tokens are sent to the Core Vault, they are no longer owned by a single agent and are instead pooled together

Security Considerations

On a quick side note regarding multi-sig security (Core Vault), it's never been the ideal scenario to use multi-sig, as it has its own weaknesses, but the Core Vault has a number of security features that you can read about in the Flare documentation. Importantly, though, this is the primitive of the anticipated FAssets v2, which uses TEEs, replacing multi-sig and improving security in a novel and spectacular way!

Managing the Core Vault

Back to the Core Vault: As mentioned, agents can push their underlying tokens to the Core Vault, which removes their collateralization commitment and replenishes their minting capacity relative to the number of underlying tokens they sent to the Core Vault.

The one side effect of this workflow is that agents must possess the underlying tokens to allow users to redeem FAssets back for their underlying token. This means that agents should maintain at least a portion of underlying tokens in their wallet to facilitate this.

To manage this side effect, agents can request underlying tokens back from the Core Vault to increase their underlying token holdings, which of course lowers their CR since they are again responsible for the safety of the tokens but enables redemptions (which increases their CR). Side note: Agents are whitelisted with the Core Vault, so who can withdraw tokens is ensured.

Key Takeaways

- Agents must carefully manage their CR by increasing it to allow users to mint and protect it from decreasing too low to avoid liquidations.

- Agents can use the Core Vault to offload underlying tokens out of their possession and into a secure vault, which in turn increases their CR, enabling further minting.

- Agents must hold underlying tokens to facilitate redemptions (converting FAssets back to underlying tokens); they can increase underlying holdings by requesting underlying tokens from the Core Vault.

- The Core Vault is a secured multi-sig wallet, which is an interim solution until FAssets v2, which will use TEEs—a new level of security.

To learn more about FAssets from official source or to verify information we suggest visiting the official Flare documentation: https://dev.flare.network/fassets/overview